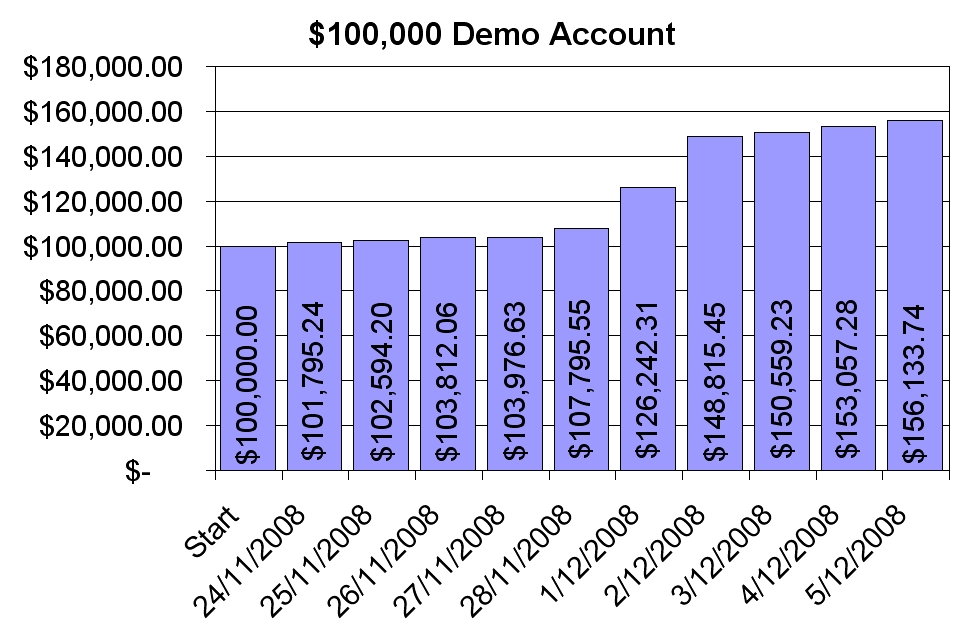

In December 2008 I learnt about Foreign Currency Trading. Reading around online I found there were a number of brokers that allowed you to trade foreign currencies and they all offered demo accounts that let you try their trading software on the live market, but using imaginary money. Coincidentally a friend of mine down in Melbourne was also just getting into currency trading and was using a broker called IG markets. He liked the way this broker worked so I gave it a go too using their demo account. In their demo account you get $100,000 and the account is active for 14 days (10 trading days). Their software is really easy to use and unlike many others you don’t need to download any software to your computer, which means you can log in and trade from wherever you have web access, rather than only on a computer where you have the software installed. My performance using the demo account is shown in Figure 1 below.

Conclusion

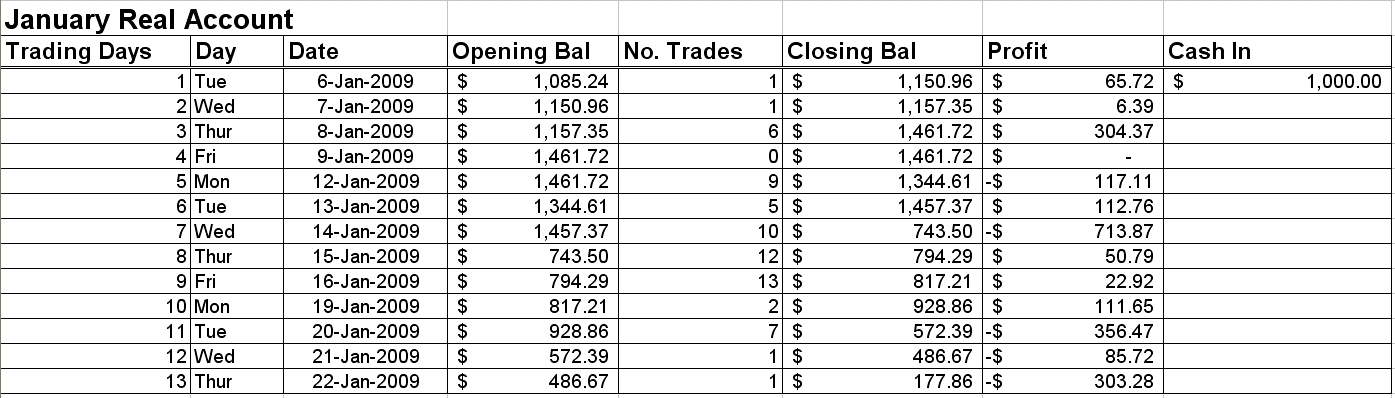

Far from being put off currency trading I feel I have learnt a lot and like anything that you fail at you can either let it turn you off it for ever, or you can get right back on that horse, perhaps a little more worse for wear, but hopefully a little more wiser. It is my aim now to raise $100,000 from the first Tier businesses in my 10 year plan (to establish AEReS as described here) so that I can again begin currency trading with sufficient starting capital to make it profitable. It is my intention that if the balance on my trading account ever drops below $100,000 that I would immediately hat trading so as not to loose the $100,000 and would instead continue to raise the money needed for AEReS by more traditional means.